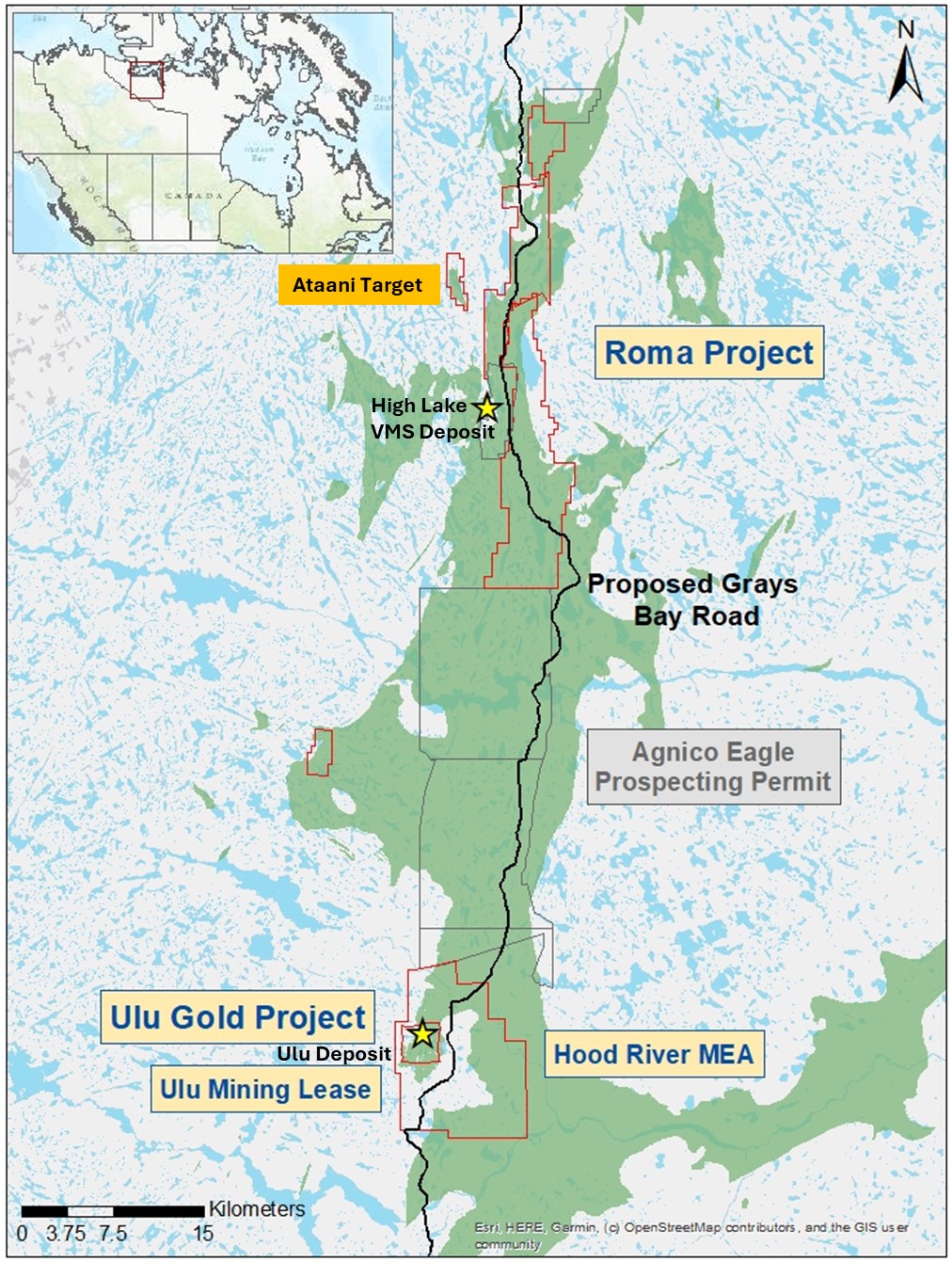

Vancouver, British Columbia--(Newsfile Corp. - October 3, 2024) - Blue Star Gold Corp. (TSXV: BAU) (OTCQB: BAUFF) (FSE: 5WP0) ("Blue Star" or the "Company") provides an update on drill holes evaluating a recently interpreted shallow dipping structure in the Flood Zone hanging wall and the initial drill evaluation of the Mikigon prospect from its 2024 exploration program on the Ulu Gold Project in the Kitikmeot region of Nunavut (Figure 1).

Highlights

- Targeted Flood Zone structure returns 3.66 metres of 8.46 g/t Au including 1.00 metre of 15.25 g/t Au

- Extended Flood Zone with drillhole intercepts of 9.61 metres of 1.83 g/t Au including 1.36 metres of 3.66 g/t Au, and 3.22 metres of 7.52 g/t Au including 2.01 metres of 10.38 g/t Au in a 30-metre step-out from the existing resource model

- Mikigon drilling indicates a pathfinder halo for the system that includes 1+ g/t Au intervals associated with quartz veining, arsenopyrite and elevated bismuth and tellurium values

Grant Ewing, CEO of Blue Star, stated, "New ideas targeting around the Flood Zone have resulted in some strong mineralization to add to our resource model with both the extension of the existing model and a new model for a hanging wall zone. The Company conducted its first pass limited drill program testing the Mikigon target that returned low grades however we now have drill core data to work with to potentially lead to a discovery at this intriguing target."

Discussion of Results

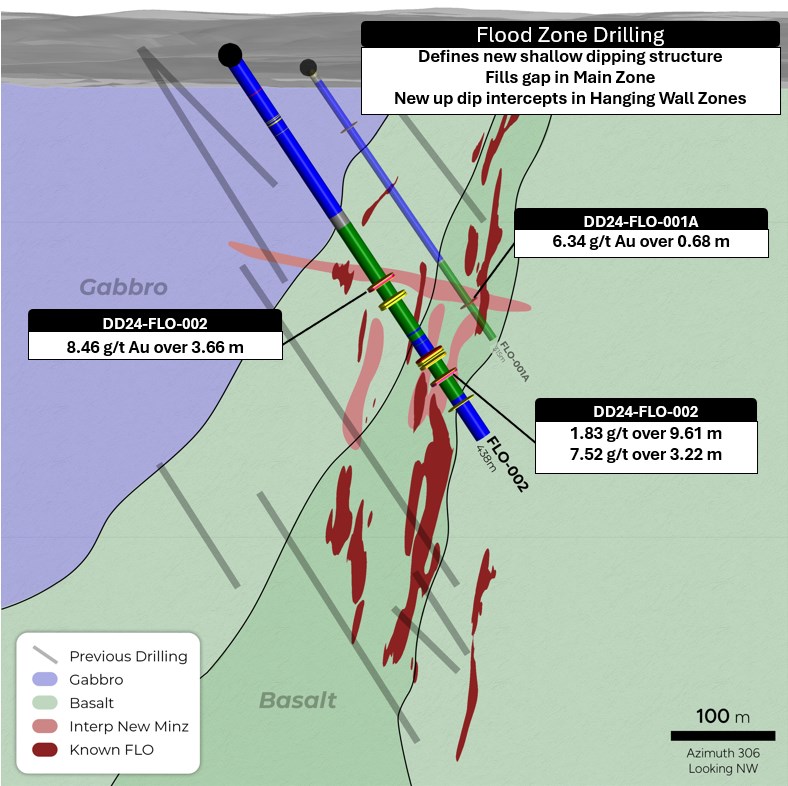

Flood Zone:

Two drill holes were drilled to test an interpreted flat vein structure in the hanging wall of the Flood Zone identified by ALS-GoldSpot's 2023 review of the Ulu Gold Deposit. A total of 717 metres was completed in the two drill holes evaluating the inferred structure targeting an average depth of 263 metres. Both drill holes intercepted the inferred structure. These intercepts along with previous drill holes will define a new mineralization zone for the Flood Zone resource model. See Table 1 for complete results.

DD24-FLO-001A collared in a greywacke unit followed by a gabbro with leucoxene alteration from 16.03 to 224.04 metres. A short interval of greywacke was observed from 224.04 to 226.15 metres, followed by massive basalt which continued until the end of the hole at 315 metres.

Mineralized zones of interest include a 0.34 metre strongly altered and weakly mineralized zone within a high zirconium, high iron, and titanium tholeiitic unit (Hi-Zr-Fe-Ti) returning 3.44 g/t Au. The targeted flat vein was intersected at 273.28 to 273.96 metres returning 6.34 g/t Au in a strongly altered Hi Fe-Ti basalt. Two weakly developed zones also occurred at 278.51 to 279.60 metres and 307.00 to 309.00 metres returning insignificant grades but having alteration that may indicate potential for better mineralization along these structures (Figure 2).

DD24-FLO-002 collared in low strain medium to coarse grained gabbro with several narrow felsic dyke intervals. The gabbro has a sharp and highly strained lower contact at 182.77 metres with an interbedded greywacke and cordierite knotted schist unit. Below the sediments is a pillowed and amygdular grey-green basalt from 196.12 to 345.31 metres, followed by a second sedimentary unit from 345.31 to 351.23 metres (greywacke). The gold intervals in this drill hole occur within the Hi-Fe-Ti unit (broader lower grade) with the strongest grades occurring at the contact between the Hi-Fe-Ti and Hi Zr-Fe-Ti units.

Mineralized zones of interest include a polymetallic vein, similar to those targeted at Nutaaq, from 42.55 to 43.22 metres that returned 0.59 g/t Au. The targeted structure was intersected from 259.39 to 263.05 metres, returning 3.66 metres of 8.46 g/t Au. An altered and mineralized section within the Hi-Fe-Ti flow returned 5.00 metres of 1.50 g/t Au. An interval of 9.61 metres around the section of sediments in the Hi-Fe-Ti unit returned 1.83 g/t Au with better grade occurring within the basalts at the contacts (5.70 g/t Au over 0.32 metres and 5.73 g/t Au over 0.38 metres). Veining at the contact of the Hi-Fe-Ti and the Hi-Zr-Fe-Ti units returned 3.22 metres of 7.52 g/t Au including 2.01 metres of 10.38 g/t Au (Figure 2)

Next steps include revising the Flood Zone deposit geological model and extending and creating mineralization shells to determine impacts from this drilling to the current resource model.

Mikigon Prospect:

An initial program of pole-dipole Induced Polarization ("IP") was completed over the Mikigon target along east-west lines spaced 150 metres apart, covering the trace of a weak magnetic signature coincident with the outcropping mineralized zone identified in 2023 that extends for 600 metres to the north where it is overlain by glacio-fluvial sediment. The survey identified moderate to strong chargeability anomalies on each line 50-100 metres below the surface (NR June 18, 2024). A 570-metre drill program of three holes was undertaken, testing below the Mikigon high grade surface showing with two drill holes, and one step out hole 100 metres to the north. See Table 1 for complete results.

The initial drill hole (DD24-MIK-001) tested 60 metres below the 47.1 g/t Au surface rock sample and was drilled into the IP chargeable zone to a total depth of 168 metres. The hole encountered folded interbedded cordierite-andalusite schist and greywacke hosting rare, weakly mineralized (pyrrhotite > pyrite) quartz veins, with a paucity of alteration. 1.92 g/t Au occurs from 93.20 to 94.20 metres, in an interval of cm-scale quartz veins with massive pyrite. The chargeability anomaly is attributed to fine grained disseminated pyrrhotite hosted by the sedimentary rocks.

The second drill hole (DD24-MIK-002) was drilled from the same pad with a steeper dip under the first hole to a depth of 201 metres. It intersected folded interbedded cordierite-andalusite schist and greywacke hosting cm-scale grey, translucent sulphide-bearing quartz veins and metre-scale white quartz veins. From 21.00 to 22.17 metres, an interval of sedimentary rock with a cm-scale grey translucent quartz vein returned 1.44 g/t Au. From 59.88 to 61.00 metres, 1.73 g/t Au was returned from a 1.12 metre interval of folded cm-scale quartz veins. A wider zone from 74.27 to 79.38 metres containing 0.73 metres of 1.37 g/t Au (from 74.27 to 75.00 metres) and 1.38 metres of 1.66 g/t Au (from 78.00 to 79.38 metres) was returned from grey translucent cm-scale quartz veins, locally containing trace pyrite mineralization.

The third drill hole (DD24-MIK-003) tested below a 5.42 g/t Au surface sample along the Mikigon trend while simultaneously investigating the source of a shallow EM anomaly and drilling into the deeper IP chargeability anomaly. The hole was drilled to 201 metres and intersected folded interbedded cordierite-andalusite schist and greywacke. An interval from 61.05-62.13 metres returned 1.08 metres of 2.05 g/t Au from cm-scale quartz veins. A second interval from 93.00-93.71 metres returned 3.59 g/t Au from an interval containing deformed quartz veins with 5% sulphides (pyrrhotite-pyrite>arsenopyrite) and chlorite alteration.

Although gold intervals are lower grade and narrow, the assay data indicates that gold occurs within a corridor of interest defined by elevated bismuth, tellurium and arsenic ("Bi-Te-As"). The next steps are to integrate structural modeling to target dilational zones coincident with the geophysical and geochemical trends along the extensive Mikigon structure.

Exploration Program Progress and Next Steps

Assay results are being reviewed, interpreted and released as they come available. After receipt of all assay data from the current program, deposit modeling will be conducted with the compiled field data and results to determine impacts to the resource base, pipeline target prioritisation and pre-planning for 2025. Incremental work this season is expected to lead to future discoveries to grow our resource base of both gold and base metals across the Ulu Project and Roma Project in the Kitikmeot Region of Nunavut.

Figure 1: Blue Star Projects and New Ataani Discovery.

Figure 2: Vertical Cross Section Looking Northwest; DD24-FLO-001A is Located Approximately 30 Metres Along Strike to the Northwest of DD24-FLO-002.

Table 1: Drill Results for Flood Zone and Mikigon.

| Hole ID | From (m) | To (m) | Length (m) | Au g/t | Notes |

| DD24-FLO-001A | 273.28 | 273.96 | 0.68 | 6.34 | shallow dipping vein |

| DD24-FLO-002 | 42.54 | 43.65 | 1.11 | 0.59 | Polymetallic vein |

| and | 259.39 | 263.05 | 3.66 | 8.46 | shallow dipping vein |

| includes | 1.00 | 15.25 | |||

| and | 279.05 | 284.05 | 5.00 | 1.50 | new zone developing? |

| and | 343.19 | 352.80 | 9.61 | 1.83 | new zone developing? |

| includes | 1.36 | 3.66 | |||

| and | 368.49 | 371.71 | 3.22 | 7.52 | extends existing zone |

| includes | 2.01 | 10.38 | |||

| DD24-MIK-001 | 93.20 | 94.20 | 1.00 | 1.92 | within Bi-Te elevated zone |

| DD24-MIK-002 | 21.00 | 22.17 | 1.17 | 1.44 | |

| and | 59.88 | 61.00 | 1.12 | 1.73 | margin of Bi-Te + As elevated zone |

| and | 74.27 | 75.00 | 0.73 | 1.37 | within 6 m Bi-Te + As elevated zone |

| and | 78.00 | 79.38 | 1.38 | 1.66 | within 6 m Bi-Te + As elevated zone |

| DD24-MIK-003 | 61.05 | 62.13 | 1.08 | 2.05 | within 3 m Bi-Te + As elevated zone |

| and | 93.00 | 93.71 | 0.71 | 3.59 | within 2 m Bi-Te + As elevated zone |

Drill samples are one half from sawn NQ sized drill core delivered under chain of custody to ALS Geochemistry in Yellowknife, NT for sample preparation which are then forwarded to ALS Canada Inc. in North Vancouver, BC for final analysis. Samples are prepared using code PREP-31 (crushing and pulverising) and analysed using codes Au-AA26 (50-gram fire assay with atomic absorption finish) and ME-MS61 (48 element four acid digestion with ICP-MS finish). Over limits for non-gold elements are ore grade four acid digestion with ICP-AES finish. The QAQC program for drilling consists of regular insertion of certified reference materials (CRMs) resulting in a 20% insertion rate.

Darren Lindsay, P. Geo. and Vice President Exploration for Blue Star, is a Qualified Person under National Instrument 43-101 ("NI 43-101") and has reviewed and approved the technical information contained in this news release.

About Blue Star Gold Corp.

Blue Star is a mineral exploration and development company focused in Nunavut, Canada. Blue Star's landholdings total 270 square kilometres of highly prospective and underexplored mineral properties in the High Lake Greenstone Belt. The Company owns the Ulu Gold Project, comprised of the Ulu Mining Lease and Hood River Property, and the Roma Project. A significant high-grade gold resource exists at the Flood Zone deposit (Ulu Mining Lease), and numerous high-potential exploration targets (gold and critical minerals) occur throughout the Company's extensive landholdings, providing Blue Star with excellent resource growth potential. The site of the future deep-water port at Grays Bay is 40 - 100 km to the north of the properties, and the proposed route corridor for the all-weather Grays Bay Road passes close by the Roma and Ulu Gold Projects.

Blue Star is listed on the TSX Venture Exchange under the symbol: BAU, the U.S. OTCQB Venture Market under the symbol: BAUFF, and on the Frankfurt Exchange under the symbol: 5WP0. For information on the Company and its projects, please visit our website: www.bluestargold.ca.

For further information, please contact:

Grant Ewing, P. Geo., CEO

Telephone: +1 778-379-1433

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX-Venture Exchange) accepts responsibility for the adequacy or accuracy of this Release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This press release contains "forward-looking statements" within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding prospective income and revenues, anticipated levels of capital expenditures for the fiscal year, expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities, and governmental and regulatory investigations and proceedings, and estimates of mineral resources and reserves on our properties.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets, strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses into our operations, developments and changes in laws and regulations, including increased regulation of the mining industry through legislative action and revised rules and standards applied by the regulatory bodies in Nunavut, changes in the price of fuel and other key materials and disruptions in supply chains for these materials, closures or slowdowns and changes in labour costs and labour difficulties, including stoppages affecting either our operations or our suppliers' abilities to deliver goods and services to us, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our equipment, and inaccuracies in estimates of mineral resources and/or reserves on our mineral properties.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/225436