Vancouver, British Columbia – February 7, 2023: Blue Star Gold Corp. (TSXV: BAU) (OTCQB: BAUFF) (FSE: 5WP0) (“Blue Star” or the “Company”) announces the results of preliminary metallurgical testing conducted on the Gnu (Nutaaq) Zone on the Ulu Gold Project (the “Project”), located in the west Kitikmeot Region of Nunavut, Canada.

Highlights

- Preliminary testing indicates 92-94% gold extraction with conventional methodology

- More than 30% of the gold is expected to occur as gravity recoverable gold (GRG)

- The Gnu (Nutaaq) Zone has similar mineral composition and metallurgical performances to the preliminary NFN Zone metallurgy study (May 2020)

- Indications that the Gnu (Nutaaq) Zone can readily be mingled with both the NFN Zone and Flood Zone Deposit mineralisation

Blue Star’s CEO, Grant Ewing, commented, “The results of the preliminary metallurgy work conducted at the Gnu Zone are very encouraging, as they indicate high gold recoveries utilizing industry standard metallurgical processes. The Gnu Zone results compare favourably with the test work conducted previously on both our flagship Flood Zone deposit and the NFN Zone and indicate that all evaluated mineralised zones could be processed together and achieve excellent gold recoveries.”

Results of the Preliminary Metallurgical Study

Preliminary mineralogical and metallurgical test work was initiated with the completion of Blue Star’s 2022 exploration campaign. Objectives of this study included the analysis of mineralogical characteristics of Gnu (Nutaaq) Zone mineralisation and the preliminary assessment of gold metallurgical performances to various process flow sheets evaluating the Flood Zone Gold Deposit. The amenability for potential co-processing with nearby advanced base metal projects was also assessed. The study was coordinated by Tetra Tech Canada Inc. and carried out by SGS Canada Inc.

A single master composite sample of approximately 30kg was assembled from coarse rejects of two slightly different mineralization styles, one being a quartz-rich portion of the vein bearing sulphide minerals and local free gold, the other being a polymetallic sulphide rich portion of the vein. The master composite was composed of half split NQ sized drill core sample coarse rejects from 46 individual assay samples from 10 drill holes. The composite was made by crushing material to finer than 10 mesh (a split was taken for bond ball mill work index determination at 6 mesh), thoroughly blending the crushed material, and then rotary split into test charges. One test charge was used to determine head assay, X-ray diffraction (XRD) and mineralogical analysis by quantitative evaluation of minerals by scanning electron microscopy (QEMSCAN). The composite head grade was 6.69 g/t gold. Head assay results for the key elements are shown in Table 1.

| Au | Ag | Cu | Pb | Zn | Fe | S | As | Cd | Co | Mo | Li |

| g/t | g/t | % | % | % | % | % | ppm | ppm | ppm | ppm | ppm |

| 6.69 | < 2 | 0.03 | < 0.01 | 0.08 | 7.21 | 2.03 | 198 | < 20 | 41 | 8 | < 30 |

| SiO2 | Al2O3 | MgO | CaO | Na2O | K2O | TiO2 | P2O5 | MnO | Cr2O3 | V2O5 | LOI |

| % | % | % | % | % | % | % | % | % | % | % | % |

| 69.4 | 6.77 | 3.12 | 4.82 | 0.67 | 0.85 | 0.69 | 0.06 | 0.14 | 0.02 | 0.03 | 2.01 |

Table 1 Head Assay Results

The grindability test shows the standard bond ball mill work index of 16.3 kWh/t which is classified as a moderately hard material to ball mill grinding.

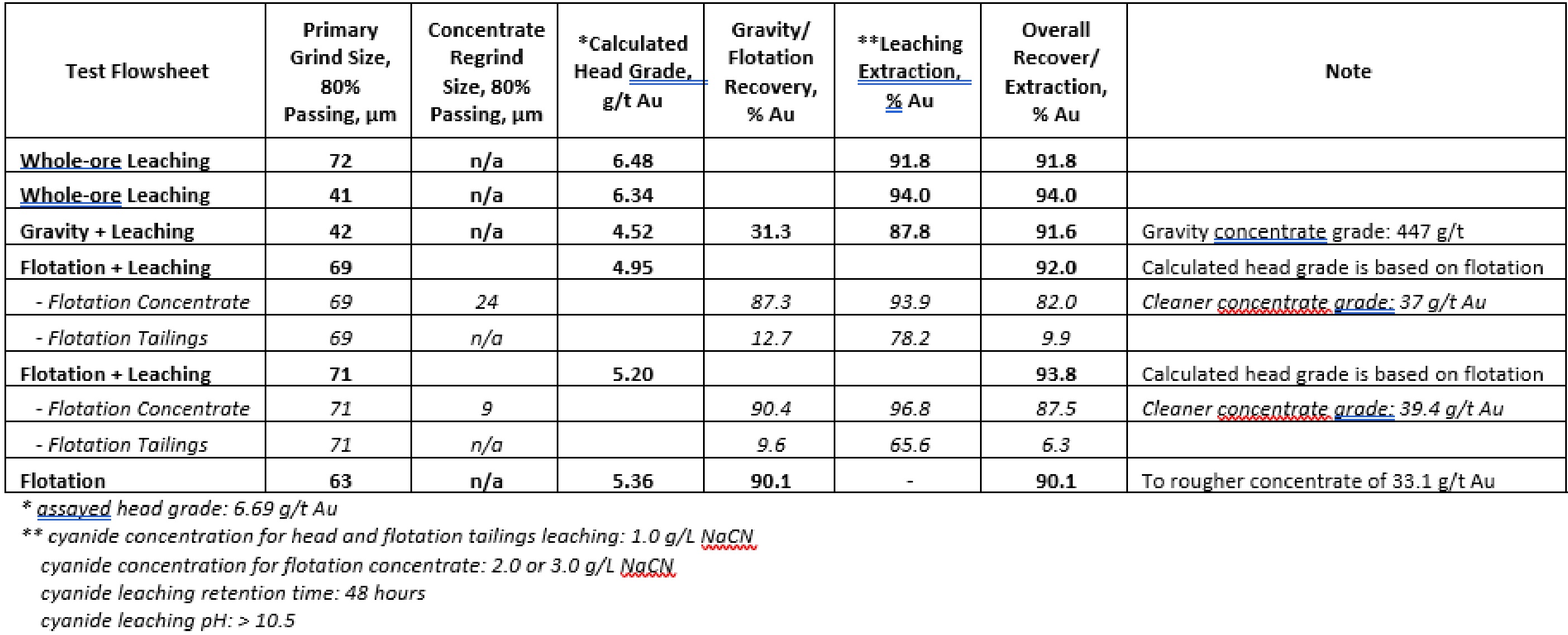

The metallurgical performances were investigated for: whole-ore cyanidation, bulk sulphide flotation followed by cyanidation of the flotation concentrate and the flotation tails, and gravity separation followed by cyanidation. The test results are summarized in Table 2.

Table 2 Metallurgical Test Results Summary

Bottle roll cyanidation of ground whole mineralization for 48 hours at grind size varied from 41 microns to 72 microns yielded encouraging gold recoveries of 91.8 to 94.0% with a sodium cyanide strength of 1.0 g/L and 40% wt. solids.

Gravity separation resulted in the collection of 31.3% of the gold which was followed by cyanidation of the gravity tails, resulting in a total gold recovery of 91.6%.

Sulfide flotation was able to recover 90.4% gold into a flotation concentrate grading 39.4 g/t Au and representing 11.9% of feed mass. Cyanidation of approximately 10 µm reground flotation concentrate at approximately 40% wt. solids and 3 g/L NaCN for 48 hours achieved a promising Au extraction of 96.8%. An overall gold extraction of 93.8% was produced from the combination of flotation + cyanidation process route.

Blue Star Gold’s Projects

The Company’s properties are located approximately 525 km NNE of Yellowknife, NT in the Kitikmeot region of western Nunavut. The hamlet of Kugluktuk is approximately 210 km to the NW. The Company owns the Ulu Gold Property mining lease, an advanced gold project, the Hood River Property that is contiguous to the Ulu lease, and the Roma Project. The three properties together encompass approximately 26,700 hectares of the highly prospective and underexplored High Lake Greenstone Belt.

The Ulu mining lease hosts the advanced stage Flood Zone gold deposit, where a significant high-grade gold resource has been outlined. Several additional gold prospects (including, but not limited to, Zebra, Contact, Central, Axis, and Gnu) are spatially related to the axis of the ~5 km long Ulu Fold, which extends from the Ulu lease onto the northern part of the Hood River property and culminates at the North Fold Nose (NFN) Zone. The recent expansion of the Hood River concession added several new target zones south of the Flood Zone gold deposit. The eastern side of the Hood River property is contiguous to the Ulu lease, and hosts over twenty known gold showings. The Hood River prospects have the same deformation history (including tight folding) as well as similar mineralization styles (acicular arsenopyrite and polymetallic quartz veins) and stratigraphic sequences as the Flood Zone. One of the most prospective target areas on the eastern Hood River property is the 4 km long Crown-Pro trend which has seen only limited drilling.

The Roma project lies in the northern section of the High Lake Greenstone Belt. The project covers high grade gold showings discovered by previous explorers, notably BHP Minerals from 1988 to 1994. Multiple significant gold showings are present within a 6.5 km x 2.4 km area on the historic Roma claim block. The original showing is a 0.30 to 3.0 m wide quartz vein exposed in outcrop and boulders for 2.0 km. In 1991, BHP drilled 10 shallow holes totalling 465 metres to test 1.72 km of strike of the vein. All drill holes intersected quartz veins from 15 m to 37 m vertically below surface. Visible gold was noted in three of the drillholes and the best results were 12.38 g/t Au over 2.31 m (including 64.0 g/t Au over 0.37 m) from DDH MD-01, and 8.69 g/t Au over 1.87 m from MD-03. No drilling was conducted downdip of the high-grade intersection in DDH MD-01 and no step out drilling to the north from this intercept was conducted. No follow up drilling is known to have been completed on this property since BHP’s initial drill program in the 1990’s. The Company has not verified the historical results from the Roma property and has presented information obtained from two assessment reports submitted by BHP Minerals Canada Ltd.; McMaster, G., (1995). Roma 3,4,5 and 6 Claims 1995 Geological and Geochemical Report, and Anonby, L. and Jopson, W., (1992). Geological, Geochemical, Geophysical and Drilling Report on the Roma 1 and 2 Claims.

The site of the future deep-water port at Gray’s Bay is 40 – 100 km to the north of the properties, and the proposed route corridor for the all-weather Gray’s Bay Road passes in close proximity to the Roma, Ulu, and Hood River projects.

Qualified Person

Darren Lindsay, P. Geo. and Vice President Exploration for Blue Star, is a Qualified Person under National Instrument 43-101 (“NI 43-101”) and has reviewed and approved the technical information contained in this news release.

About Blue Star Gold Corp.

Blue Star is a gold company focused on exploration and development within Nunavut, Canada. Blue Stars landholdings total approximately 267 square kilometres of highly prospective and underexplored mineral properties in the High Lake Greenstone Belt, Nunavut. The Company owns the Ulu Gold Property mining lease, an advanced gold project, the highly prospective Hood River Property that is contiguous to the Ulu lease, and the Roma Project. A significant high-grade gold resource exists at the Flood Zone deposit (Ulu lease), and numerous high-grade gold occurrences and priority targets occur throughout the Ulu, Hood River and Roma Projects.

Blue Star is listed on the TSX Venture Exchange under the symbol: BAU, the U.S. OTCQB Venture Market under the symbol: BAUFF, and on the Frankfurt Exchange under the symbol: 5WP0. For information on the Company and its projects, please visit our website: www.bluestargold.ca.

For further information, please contact:

Grant Ewing, P. Geo., CEO

Telephone: +1 778-379-1433

Email:

Raffi Elmajian, Corporate Communications Manager

Telephone: +1 778-379-1433

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX-Venture Exchange) accepts responsibility for the adequacy or accuracy of this Release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This press release contains "forward-looking statements" within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding prospective income and revenues, anticipated levels of capital expenditures for fiscal year, expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings, and estimates of mineral resources and reserves on our properties.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets, strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses into our operations, developments and changes in laws and regulations, including increased regulation of the mining industry through legislative action and revised rules and standards applied by the regulatory bodies in Nunavut, changes in the price of fuel and other key materials and disruptions in supply chains for these materials, closures or slowdowns and changes in labour costs and labour difficulties, including stoppages affecting either our operations or our suppliers' abilities to deliver goods and services to us, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our equipment, and inaccuracies in estimates of mineral resources and/or reserves on our mineral properties.