Vancouver, British Columbia – November 9, 2022: Blue Star Gold Corp. (TSXV: BAU) (OTCQB: BAUFF) (FSE: 5WP0) (“Blue Star” or the “Company”) provides an update on the development of its target pipeline conducted across its highly prospective Ulu, Hood River, and Roma projects (“Projects”) located in the Kitikmeot Region of Nunavut.

Program Highlights

Priority Target Areas Include:

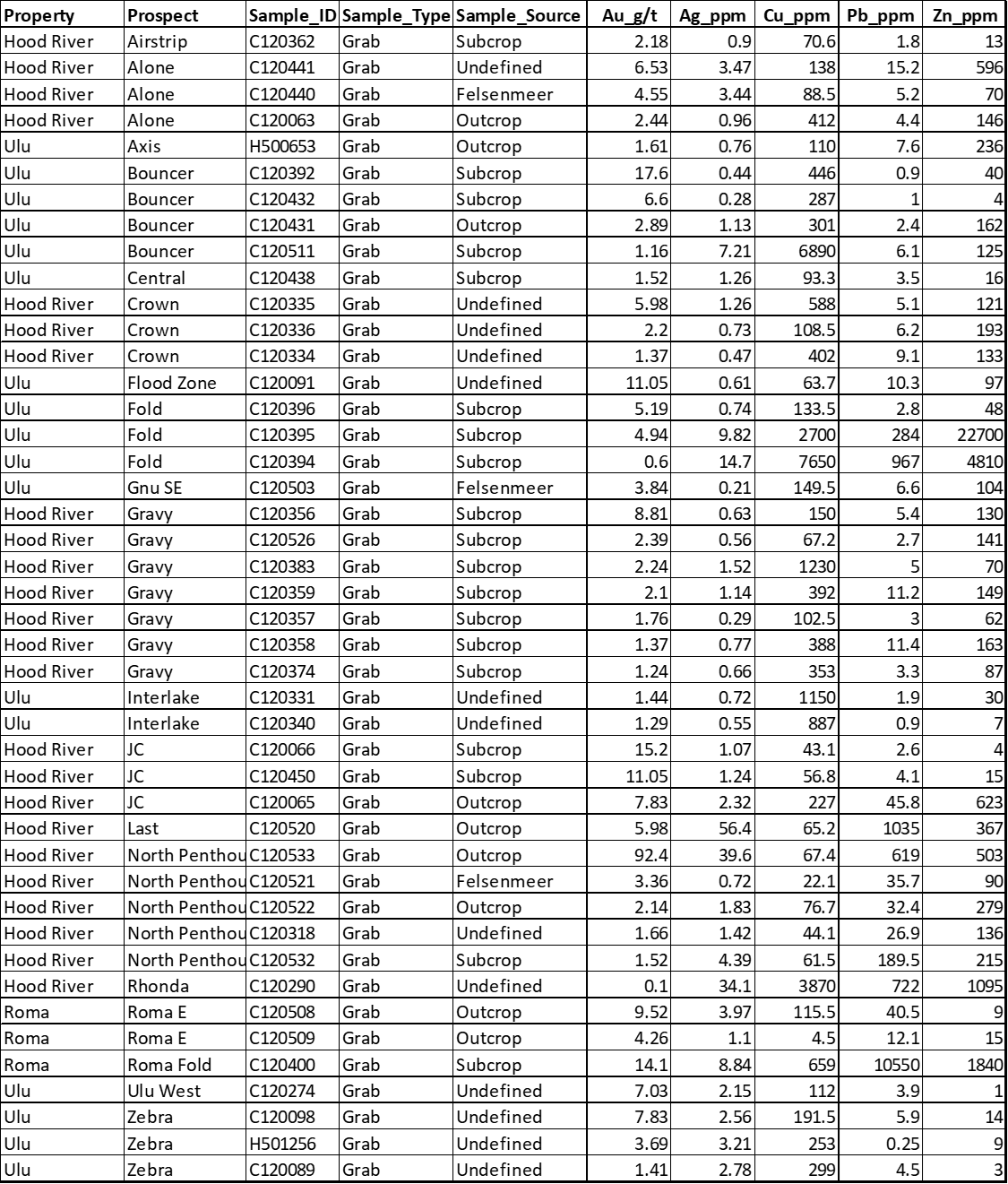

- Bouncer trend (~1,500 metres W of Flood Zone deposit): +800-metre-long structural trend with variable amounts of quartz veining, silicification and sulphide mineralisation returned samples grading 17.6 g/t Au and 6.60 g/t Au with local elevations in copper;

- Zebra-Dagg corridor (~1,800 metres NNW of Flood Zone deposit): 900-metre-long section of the Ulu fold hinge with two contacts of interest associated with attenuated sediments returning samples grading 7.83 g/t Au and 3.69 g/t Au; and

- Gravy trend (~5,500 metres ESE of Flood Zone deposit): +950-metre-long arsenopyrite rich structural trend returning values that include 8.81 g/t Au and 3.84 g/t Au among numerous multi-gram samples over 125 metre to 250-metre-long sections of the trend.

A number of shorter strike length trends with significant results include: JC showing returned samples grading 15.20 g/t Au and 11.05 g/t Au, North Penthouse showing returned samples grading 92.40 g/t Au, Ulu West Fold showing returned samples grading 4.94 g/t Au and 2.27% Zinc, Alone showing returned samples grading 6.53 g/t Au, and Roma Fold showing returned samples grading 14.1 g/t Au with 1.0% lead.

Grant Ewing, Blue Star’s CEO stated: “It is very encouraging to see the large number of high-quality target areas outlined during the first systematic regional review at our Projects in over 20 years. The high gold grades returned from sampling highlight many different trends demonstrating the excellent potential for new discoveries. The Bouncer trend is an example of an area that has strong potential; it is an extensive structure with high gold grades at surface, no history of drilling, and located less than 2 kilometres from the Flood Zone gold deposit.”

Exploration Program Summary

During the 2022 program, the Company completed approximately 3,865 metres of drilling in 28 holes, 3,055 line-km of airborne magnetics surveying, and a regional till sampling program on the Roma Project. In addition, 58 of the >100 showings in the target pipeline were reviewed, prospected, and/or mapped.

Discussion of Exploration Results Reported

The development of a project pipeline within the Company’s large land package is an important step to rapidly evaluate, rate/rank and prioritise targets for future drill testing. This initial work included review of more than half of the known targets, with a bias towards proximity to existing resources. The field program included prospecting, mapping, and sampling to confirm and provide additional current information on the multitude of targets.

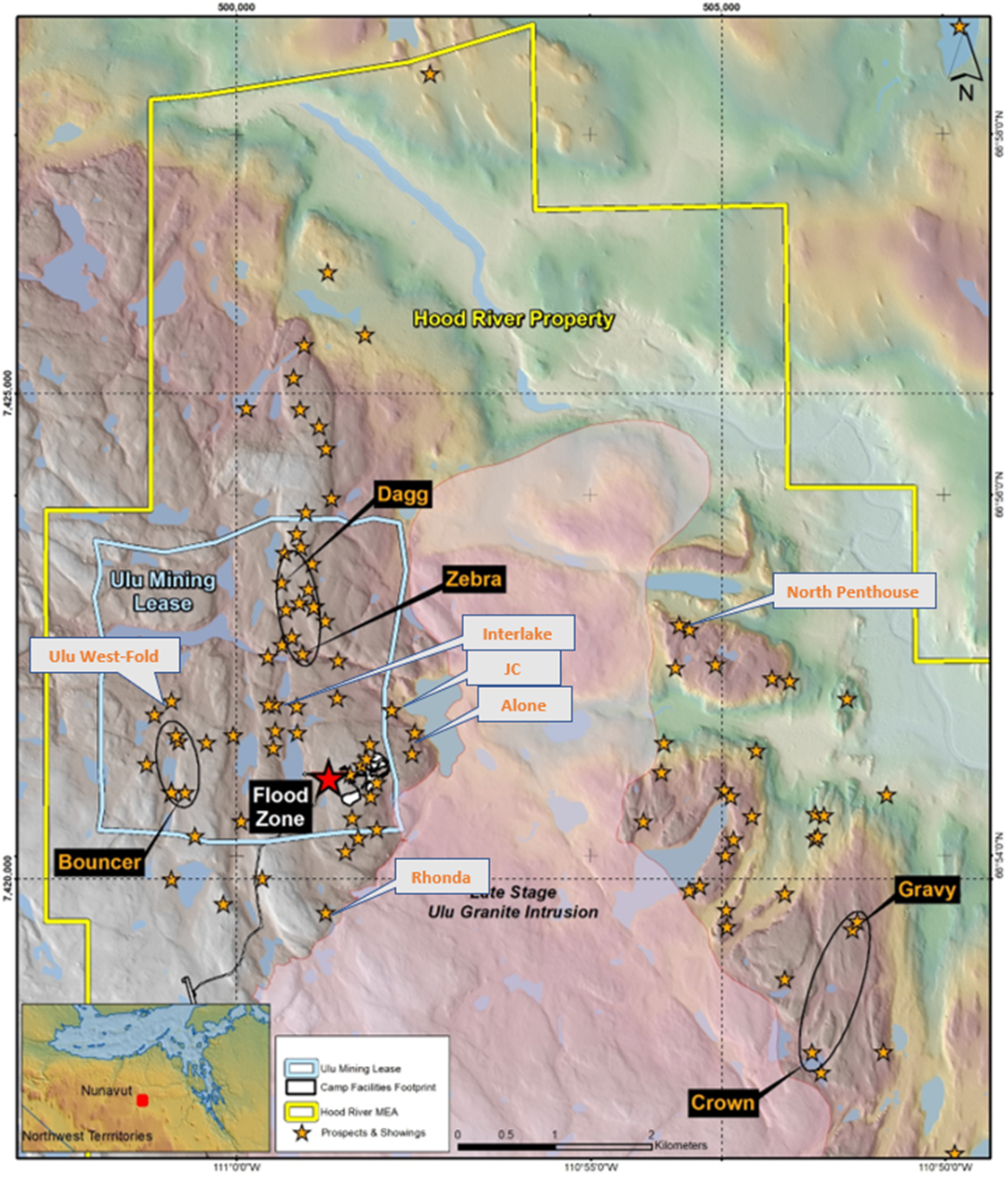

Summary of Pipeline Areas of Interest (see figures 2 and 3)

Bouncer trend: Located approximately 1500m due West of the Flood Deposit and within 1000m of the existing road, the +800m long trend returned eight anomalous samples including 17.60, 6.60 and 2.84 g/t gold samples. Anomalous samples are generally clustered in a 320m and a 180m section of the trend which is open to the north and south; no historical drilling has been conducted in this area.

Zebra trend: This complex area on the Ulu Fold hinge is comprised of a shallowly north plunging fold with a core of gabbro overlain by sediments which are overlain by mafic flows. The fold is extremely attenuated in the sediments with abundant alteration (gossan) at both the upper and lower sediment contacts. Historical and current sampling has returned anomalous gold values from quartz veining and weathered gossanous material. Four historical drill holes evaluated quartz veins within the gabbro (best intercept was 8.31 g/t gold over 2.50 m) however the current sampling program targeted the contacts and disseminated arsenopyrite within the sediment. Sample results varied from detection limit to 7.83, 3.69 and 1.41 g/t gold.

Gravy trend: This +950 m long trend of structurally controlled silicification and disseminated arsenopyrite mineralisation may be continuous with the main Crown Trend inferring continuity through a 500m long tundra covered valley. If the trend is continuous across the valley this would indicate an inferred strike extent of +2,200 m within the Crown-Pro Trend which is stratigraphically analogous to the Ulu fold which hosts the Flood deposit. There is no known drilling in the data base for the Gravy trend however one drill casing was located in the field proximal to the showing.

JC showing: This area consists of roughly 30m2 of anomalous veining with trace sulphides; the best results returned 15.20, 11.05 and 1.83 g/t gold grades. The area requires additional follow-up due to poor outcrop exposure. It is located within sediments and is within 300m of the Gnu Zone. No historical drilling has been conducted in this area.

North Penthouse area: This large area has numerous exposures of irregular silicified zones and quartz veins with arsenopyrite mineralisation. Field checking identified cut channel samples that are not within the sample database; a check sample of one channel returned 92.40 g/t gold. At least a dozen historical holes are recognised evaluating at five different targets within the broad area. Additional work is required to capture existing sample locations, map alteration and structure, compile drill data and generate a coherent target for drill testing.

Ulu West-Fold showing: Two styles of mineralisation were noted in the area; a quartz vein traceable for 70m with samples up to 7.83 g/t gold and a 100m long zone of disseminated sulphides which returned values including 5.19 and 4.94 g/t gold. There is no historical drilling in this area.

Alone showing: A ~170m long NE-SW trending vein hosted within the same gabbro that hosts the Gnu Zone polymetallic veins. Sampling returned anomalous areas returning grades of 6.53, 4.55 and 2.44 g/t gold. The target is located roughly 600m from the Gnu Zone and 725m from the Flood Deposit. One 1991 drillhole (91VD099) tested the Alone target, returning 1.99 g/t Au over 0.68m.

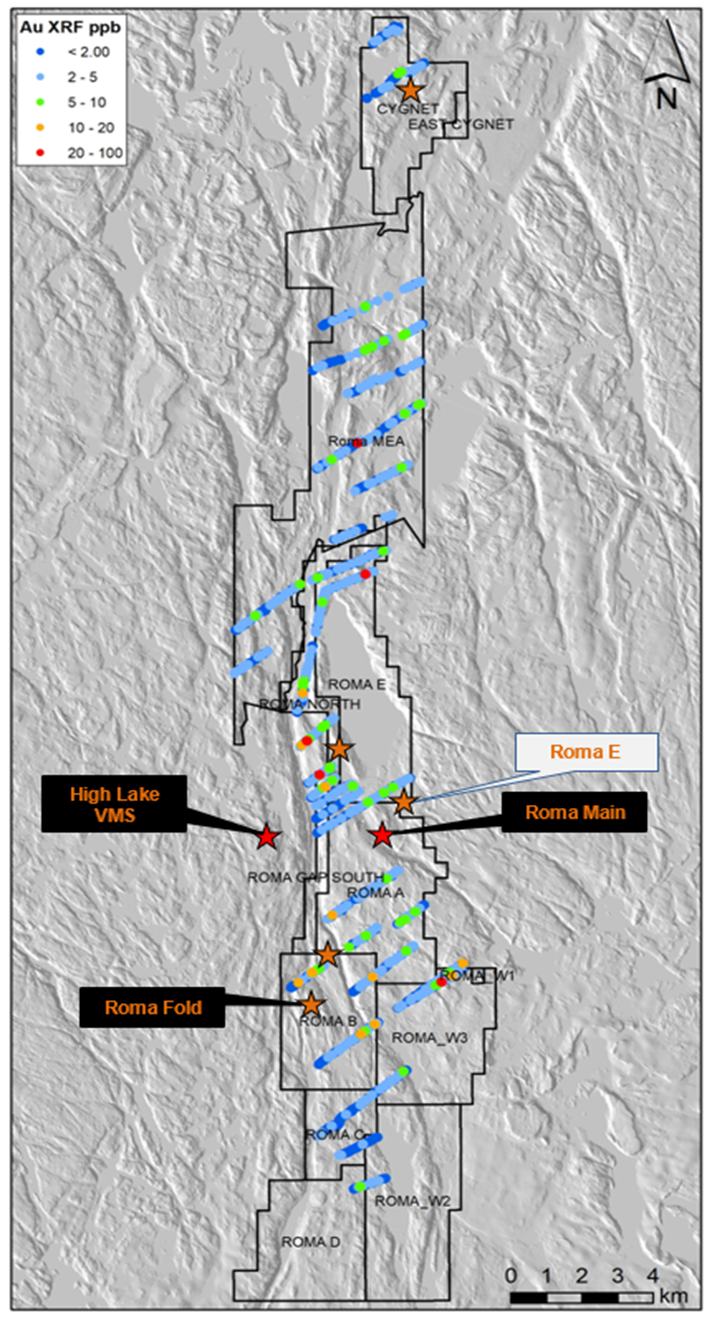

Roma Fold showing: Limited prospecting returned a sample of 14.10 g/t gold and 1% lead with elevated silver from carbonate altered rock with arsenopyrite mineralization, similar to a 12.10 g/t gold sample collected in 2021. There is no historical drilling in this area.

Roma E showing: Samples in the vicinity of the Roma Main showing returned 9.52 and 4.26 g/t gold grades which require additional follow-up.

Crown-B showing: Sampling of two discontinuous parallel quartz veins returned 5.98, 2.20, 1.37 and 0.98 g/t gold grades. The sampling program confirmed 95m of a 215m exposure; requires additional sampling/channel sampling and detailed mapping. Two short historic drillholes have tested this area, one returning 5.58 g/t Au over 0.5m (OD-5) and the other not encountering mineralization due to bad ground conditions that required the rig be set up south of the desired location (OD-6).

Interlake showing: This is a north-south 160m long trend of anomalous samples; confirmation samples returned 1.44 and 1.29 g/t Au. Two historical drill holes (12UE004 and 005) partially tested the target with results of 2.73 g/t gold over 1.97m and 3.33 g/t gold over 2m.

Rhonda showing: A limited sampling effort identified interesting high silver, copper, and zinc values. There is no historical drilling in this area.

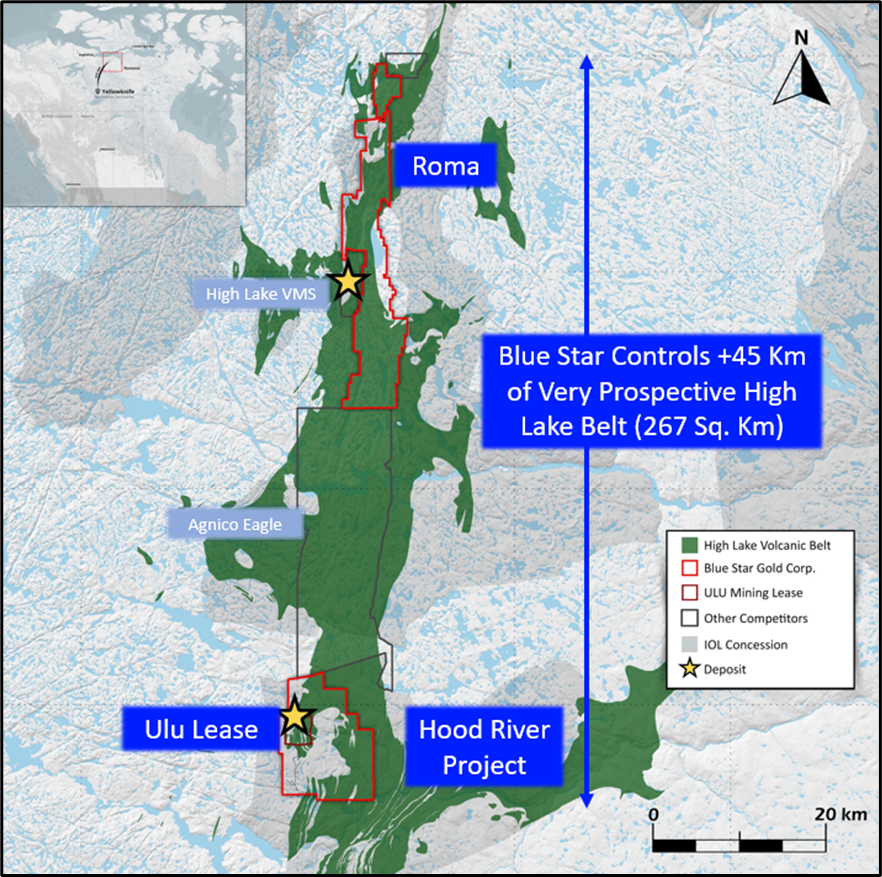

Figure 1: Blue Star Projects.

Figure 2: Target pipeline plan map.

Figure 3: Roma Projects targets on gold in till basemap.

Table 1: Notable exploration sample results; > 1 g/t Au or anomalous silver, copper, zinc, lead (Ag, Cu, Zn, Pb respectively).

Blue Star Gold’s Projects

The Company’s properties are located approximately 525 km NNE of Yellowknife, NT in the Kitikmeot region of western Nunavut. The hamlet of Kugluktuk is approximately 210 km to the NW. The Roma property lies approximately 30 km north of the Ulu-Hood River property. The total area of Blue Star’s projects encompasses 267 km2 of the highly prospective and underexplored High Lake Greenstone Belt.

The Ulu lease and the contiguous Hood River property together encompass greater than 12,000 hectares (120 km2) of highly prospective exploration ground. The recent acquisition of the prospective and underexplored Roma property that lies approximately 30 km north increased the Company’s landholdings by more than 14,000 hectares (140 km2) in the High Lake Greenstone Belt.

The Ulu mining lease hosts the advanced stage Flood Zone gold deposit, where a significant high-grade gold resource has been outlined. Several additional gold prospects (including, but not limited to, Zebra, Contact, Central, Axis, and Gnu) are spatially related to the axis of the 5 km long Ulu Fold, which extends from the Ulu lease onto the northern part of the Hood River property and culminates at the North Fold Nose Zone. The recent expansion of the Hood River concession added several new target zones south of the Flood Zone gold deposit. The eastern side of the Hood River property is contiguous to the Ulu lease, and hosts over twenty known gold showings. The Hood River prospects have the same deformation history (including tight folding) as well as similar mineralization styles (acicular arsenopyrite and polymetallic quartz veins) and stratigraphic sequences as the Flood Zone. One of the most prospective target areas on the eastern Hood River property is the 4 km long Crown-Pro trend which has seen only limited drilling.

The Roma project lies in the northern section of the High Lake Greenstone Belt. The project covers high grade gold showings discovered by previous explorers, notably BHP Minerals from 1988 to 1994. Multiple significant gold showings are present within a 6.5 km x 2.4 km area on the historic Roma claim block. The original showing is a 0.30 to 3.0 m wide quartz vein exposed in outcrop and boulders for 2.0 km. In 1991, BHP drilled 10 shallow holes totalling 465 metres to test 1.72 km of strike of the vein. All drill holes intersected quartz veins from 15 m to 37 m vertically below surface. Visible gold was noted in three of the drillholes and the best results were 12.38 g/t Au over 2.31 m (including 64.0 g/t Au over 0.37 m) from DDH MD-01, and 8.69 g/t Au over 1.87 m from MD-03. No drilling was conducted downdip of the high-grade intersection in DDH MD-01 and no step out drilling to the north from this intercept was conducted. No follow up drilling is known to have been completed on this property since BHP’s initial drill program in the 1990’s. The Company has not verified the historical results from the Roma property and has presented information obtained from two assessment reports submitted by BHP Minerals Canada Ltd.; McMaster, G., (1995). Roma 3,4,5 and 6 Claims 1995 Geological and Geochemical Report, and Anonby, L. and Jopson, W., (1992). Geological, Geochemical, Geophysical and Drilling Report on the Roma 1 and 2 Claims.

The site of the future deep-water port at Gray’s Bay is 40 – 100 km to the north of the properties, and the proposed route corridor for the all-weather Gray’s Bay Road passes in close proximity to the Roma, Ulu, and Hood River projects.

Technical Disclosure

Sample results presented are from grab samples which are selective samples by definition and may not be representative of the sampled mineralized structure or system. Samples were prepared by ALS Yellowknife-Geochemistry and analyzed at ALS Global, North Vancouver. Gold analysis was by fire assay using ALS code Au-AA26 and multielement analysis by code ME-MS61. Control samples include a crush duplicate every twenty samples; certified reference material was inserted once every ten samples. The range of gold results from exploration samples analysed was detection limit to 92.40 g/t Au.

Qualified Person

Darren Lindsay, P. Geo. and Vice President Exploration for Blue Star, is a Qualified Person under National Instrument 43-101 (“NI 43-101”) and has reviewed and approved the technical information contained in this news release.

About Blue Star Gold Corp.

Blue Star is a gold company focused on exploration and development within Nunavut, Canada. Blue Stars landholdings total approximately 270 square kilometres of highly prospective and underexplored mineral properties in the High Lake Greenstone Belt, Nunavut. The Company owns the Ulu Gold Property mining lease, an advanced gold project, the highly prospective Hood River Property that is contiguous to the Ulu lease, and the Roma Project. A significant high-grade gold resource exists at the Flood Zone deposit (Ulu lease), and numerous high-grade gold occurrences and priority targets occur throughout the Ulu, Hood River and Roma Projects.

Blue Star is listed on the TSX Venture Exchange under the symbol: BAU, the U.S. OTCQB Venture Market under the symbol: BAUFF, and on the Frankfurt Exchange under the symbol: 5WP0. For information on the Company and its projects, please visit our website: www.bluestargold.ca.

For further information, please contact:

Grant Ewing, P. Geo., CEO

Telephone: +1 778-379-1433

Email:

Raffi Elmajian, Corporate Communications Manager

Telephone: +1 778-379-1433 ext. 107

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX-Venture Exchange) accepts responsibility for the adequacy or accuracy of this Release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This press release contains “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding prospective income and revenues, anticipated levels of capital expenditures for fiscal year, expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings, and estimates of mineral resources and reserves on our properties.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets, strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses into our operations, developments and changes in laws and regulations, including increased regulation of the mining industry through legislative action and revised rules and standards applied by the regulatory bodies in Nunavut, changes in the price of fuel and other key materials and disruptions in supply chains for these materials, closures or slowdowns and changes in labour costs and labour difficulties, including stoppages affecting either our operations or our suppliers’ abilities to deliver goods and services to us, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our equipment, and inaccuracies in estimates of mineral resources and/or reserves on our mineral properties.