Vancouver, British Columbia – January 19, 2022: Blue Star Gold Corp. (TSXV: BAU) (FSE: 5WP0) (BAUFF: OTC) (“Blue Star” or the “Company”) is pleased to provide results from an additional eight (8) drill holes from the 2021 exploration program at its Ulu Project located in the High Lake Greenstone Belt, Nunavut. Results from ten (10) drill holes remain outstanding.

Highlights from the recently completed drill program:

- Central Zone fence: Central-C (21BSG010) returned 5.21 g/t gold over 3.00 metres approximately 50 metres vertically below surface

- Axis Zone returns continuous anomalous values from modelled structure adjacent to the underground workings; 21BSG009 returns 2.51 g/t gold over 3.00 metres

- Axis/Central zone returns gold values at a similar geochemically defined contact as the one that hosts the Flood Zone Deposit; 21BSG015 returned 3.80 g/t gold over 0.79 metres

- Potential important new targeting tool identified:

o Geochemical sampling results have identified high, moderate, and low titanium basalts (high-Ti, mod-Ti, low-Ti) at Ulu. The SW dipping Flood Zone deposit is hosted in a high angle structure juxtaposing the high-Ti basalt unit with the mod-Ti basalt on the west limb of the Ulu anticline. The NE dipping Central “C” Zone is found at the faulted contact between the high-Ti and mod-Ti units on the east limb of the fold

o The recognition that the host structures for gold mineralization occur at faulted contacts between lithochemically distinct mafic flows provides a deeper understanding of structural controls on mineralization and allows for more focused targeting for future drill programs

CEO Grant Ewing stated, “It is very encouraging that the technical team continues to find new and innovative ways to more effectively assess the multitude of target areas over our extensive district scale landholdings. High precision lithogeochemistry is unraveling the volcanic stratigraphy and linked with our structural interpretation, we now have a much better understanding of the controls of the major mineralized breaks. The current priority sequence is initially testing targets near our high-grade Flood Zone gold deposit, and gradually stepping out to more regional priority target zones. We look forward to receiving the balance of the results from our 2021 program as some of the strongest results are anticipated in the drill holes that are still outstanding.”

“Results for an additional ten drill holes are outstanding from the 2021 exploration program in the NFN, Central and Gnu areas but are expected soon. With recent geochemical work refining the stratigraphy hosting the better-known mineralized zones in conjunction with our results to date, the exploration team is working on defining a balanced infill, expansion and new discovery program for 2022,” commented Darren Lindsay, Vice President Exploration.

Summary

Recent reviews of the geochemical data have indicated the presence of a ‘high-Ti’ and at least one ‘low-Ti’ mafic volcanic sequence. The contact zones of the high-Ti sequence appear to be closely associated with strong alteration and gold anomalism including defining the Flood Zone deposit structural corridor. Further work is required to conclusively add this targeting tool to our exploration toolbox.

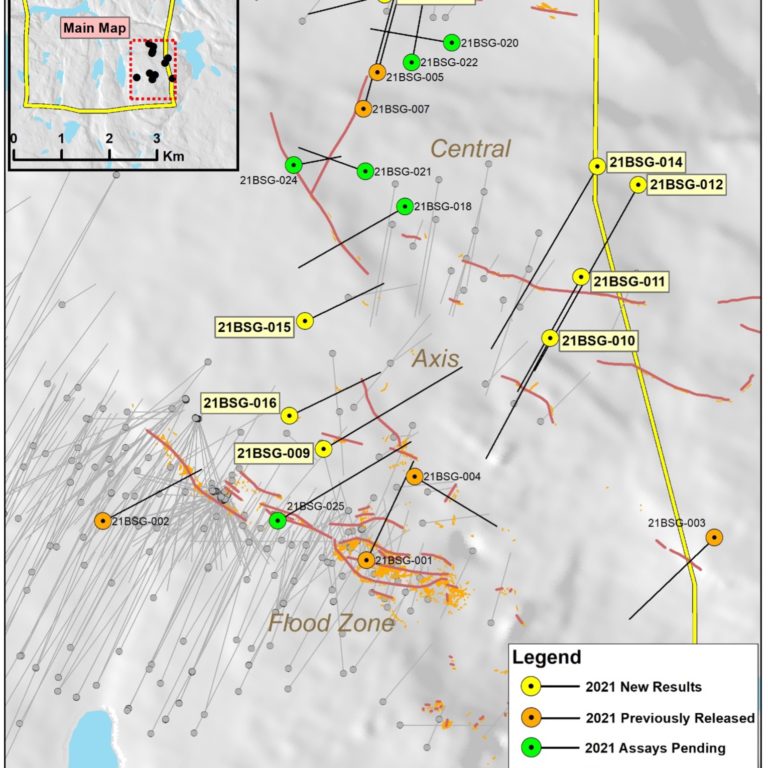

The results presented today are the initial drill evaluations of the Axis Zone, a target zone located in the hanging-wall of the Flood Zone Deposit within 100 metres of the historical underground workings, and a drill fence across three parallel zones known as Central A, B, and C located approximately 250 metres east of the Flood Zone deposit.

The Axis Zone target was defined by historical surface sampling, alteration mapping and limited historical shallow drilling. Blue Star drilling confirmed the mineralized trend with stronger results located closer to the projected lateral intersection of the Axis Zone and Central Zone. This is also an area where the geochemically defined stratigraphy indicates a similar structural juxtaposition as the one observed at the Flood Zone.

A drill fence testing the Central Zones evaluated the three known mineralized planes from shallow 50 metre vertical levels to deeper 300 metre vertical levels below surface. Drill results show that gold mineralization extends to the deepest level tested. Current understanding suggests that the three zones may converge at depth, providing a compelling target area for future drill campaigns.

One additional drill hole from the original Gnu polymetallic vein is reported which did not intercept the expected target most likely due to a change in structural trend of the interpreted vein feature. Additional detailed drilling is required to follow up in this target area in 2022 (previously reported 21BSG006: 2.18 m of 11.06 g/t gold).

Discussion of results

Gnu Zone

21BSG-008: Gnu Zone original polymetallic vein test. This drillhole tested the continuation of a modelled high-grade polymetallic quartz vein at a vertical depth of 90 metres, collared south along strike from BS2020-ULU-007 (52.7 g/t gold from 25.0 – 27.0 m), 92VD161 (18.8 g/t gold from 165.37 – 167.85 m), and 21BSG-006 (11.06 g/t gold from 48.04 – 50.22 m). The drillhole intersected gabbro for the length of the hole, with localized moderate to strong leucoxene alteration. Although some intervals of anomalous arsenic were seen in assay data, no intervals of anomalous gold were reported. The polymetallic quartz vein was not intersected, but lithological and assay data has helped inform a new working interpretation of the location, azimuth and dip of the target which will be used for further drill evaluation.

Axis Zone

21BSG-009: Axis Zone acicular trend. This drillhole tested two modelled basalt-hosted acicular arsenopyrite trends situated between the Flood Zone and the Central acicular arsenopyrite trends. A highly strained interval with quartz, 4% acicular arsenopyrite, 7% blebby chalcopyrite, 2% blocky chalcopyrite and 4% blocky pyrite was intersected from 83.00 – 86.00 metres and returned gold assay values of 2.51 g/t. These drill results helped inform a more robust reinterpretation of the Axis Zone acicular arsenopyrite trend, which has been remodelled as one, rather than two, planes subparallel to both the Flood Zone and the Central acicular arsenopyrite trends. This interpretation is supported by drill results from 21BSG-016.

21BSG-016: Axis Zone acicular trend. Similar to hole 21BSG-009, this drillhole tested two modelled acicular arsenopyrite Axis trends. It is collared 60 metres northwest of 21BSG-009 and intersects variably textured and altered basalt for the length of the hole. From 88.05 – 89.49 metres, 2.26 g/t gold (including 4.30 g/t gold over 0.49 metres) was intersected in a basalt-hosted calc-silicate altered quartz vein with 7% subhedral arsenopyrite, 2% pyrrhotite and 1% pyrite. These drill results support the re-interpretation of the location, azimuth and dip of the Axis plane which was initiated by results from hole 21BSG-009.

21BSG-015: Axis Zone/Central acicular trend. This hole tested the two modelled acicular arsenopyrite trends within the Axis zone and the western-most plane of the Central trends (the ‘C’ trend). Basalt with two minor meter-scale intervals of sediment is intersected from the top to bottom of the hole. From 78.08 – 78.87 metres an interval hosting 15% acicular arsenopyrite, 3% blebby arsenopyrite, 3% blocky and stringers of pyrite, and 2% blocky and blebby pyrrhotite returned 3.80 g/t gold (including 6.80 g/t gold from 78.08 – 78.44 metres). This interval correlates to the Central C trend, or the intersection of one or more Axis trends with the Central C trend.

Central Zones

21BSG-010: Central Zone acicular trend. This drillhole tested the Central Zone B and C acicular arsenopyrite trends and intersected variably textured and altered basalt throughout. At 16.00 – 17.00 metres depth, the Central B plane is interpreted to be intersected as a brecciated structure which returned a modest, but relatively elevated, gold value of 0.42 g/t over 1 metre. The C plane is intersected from 91.00 – 94.00 metres as a brecciated and highly strained interval of fine-grained basalt, with strong silicification and bands of biotite and chlorite alteration, with 10% acicular arsenopyrite, 4% pyrrhotite, 3% chalcopyrite, and 3% pyrite. The interval grades 5.21 g/t gold over 3 metres. This interval corresponds with a transition from high-Ti basalt outside of the anomalous gold zone to low/moderate-Ti basalt from 92.00 – 94.00 metres. From 156.00 – 157.00 metres, 1.94 g/t gold over 1 metre is intersected, corresponding with a new plane of interest.

21BSG-011: Central Zone acicular trend. This drillhole tested the Central A, B, and C planes, and intersected variably textured basalt with minor sediment throughout. From 20.00 – 21.12 metres the Central A plane was intersected in basalt, grading 1.08 g/t gold over 1.12 metres, and correlating with a transition from moderate-Ti to low-Ti basalt. The Central B plane was not intersected or not mineralized. At the predicted depth, basalt is strongly altered (variably bleached from 113 – 124 metres, with 5% chaotically oriented mm-scale quartz-carbonate-Fe oxide veinlets). The Central C plane is intersected between 192.74 – 198.40 metres. The gold grade is low, but relatively elevated (0.35 g/t over 1 metre from 192.21 – 193.21 metres; 0.69 g/t over 1.2 metres from 197.20 – 198.40 metres). A sedimentary unit intersected just above the weakly anomalous basalt intersection has accommodated ductile (folded primary mica and chlorite) and brittle (two intervals of fault gouge at 10 cm and 21 cm wide) strain.

21BSG-012: Central Zone acicular trend. This hole tested all three Central planes. It is collared in gabbro which extends for ~14 metres followed by a ~15 metre interval of sediment then basalt for the rest of the hole, with one ~30 metre interval of gabbro from 247.80 – 276.10 metres. None of the planes of interest are well expressed. Intervals of high strain and brecciation, sometimes with fault gouge, may be the expression of the Central planes in this drillhole. Not corresponding to a known zone, relatively elevated gold at 0.27 g/t over 1.07 metre occurs from 15.00 – 16.07 metres at the margin of a fine-grained basalt and it’s lower, faulted contact with sediment. The basalt-sediment contact is mineralized in other target areas.

The predicted depth of the Central A plane coincides with a basalt and its lower contact with a gabbro at 247.80 metres; this contact is marked by a highly strained mineralized zone from 242.24 – 242.60 metres comprising 6% pyrrhotite and 4% pyrite. The interval from 386.18 – 393.40 metres contains a 10 cm wide interval of brecciation within a high strain zone and up to 5% pyrrhotite-pyrite, and a 55 cm wide interval with moderate fault gouge and several fractures. No anomalous gold values were returned, but the interval is at the correct depth to correspond with the Central C plane.

21BSG-014: Central Zone acicular trend. This drillhole targeted the three Central planes. Like hole 21BSG-012, it is collared in basalt, and intersects thin intervals of gabbro then sediment at the top of hole, then basalt for the remainder of the hole. Two intervals with anomalous gold correspond to the Central B and C planes. From 345.12 – 346.12 metres, 1.18 g/t gold is intersected over 1 metre; from 358.58 – 362.62 metres, 2.72 g/t gold is intersected over 4.04 metres.

Table 1. Drill hole results (uncut) using core lengths compositing +1 g/t gold values with acceptable internal waste of up to 2 metres. True widths estimated to be 90% – 95% of intervals.

| Hole ID | Target | From (m) | To (m) | Length (m) | Gold g/t |

| 21BSG-008 | Gnu – polymetallic | nsi | |||

| 21BSG-009 | Axis Zone | 83.00 | 86.00 | 3.00 | 2.51 |

| 21BSG-010 | Central Zone – C | 91.00 | 94.00 | 3.00 | 5.21 |

| Includes | 92.00 | 93.00 | 1.00 | 7.57 | |

| 21BSG-010 | Central Zone – NEW | 156.00 | 157.00 | 1.00 | 1.94 |

| 21BSG-011 | Central Zone | 20.00 | 21.12 | 1.12 | 1.08 |

| 21BSG-012 | Central Zone | nsi | |||

| 21BSG-014 | Central Zone | 345.12 | 346.12 | 1.00 | 1.18 |

| 21BSG-014 | Central Zone | 358.58 | 362.62 | 4.04 | 2.72 |

| Includes | 358.58 | 360.62 | 2.04 | 3.60 | |

| Includes | 361.62 | 362.62 | 1.00 | 3.55 | |

| 21BSG-015 | Axis/Central Zone | 78.08 | 78.87 | 0.79 | 3.80 |

| includes | Axis/Central Zone | 78.08 | 78.44 | 0.36 | 6.80 |

| 21BSG-016 | Axis Zone | 88.05 | 89.49 | 1.44 | 2.26 |

| Includes | 89.00 | 89.49 | 0.49 | 4.30 |

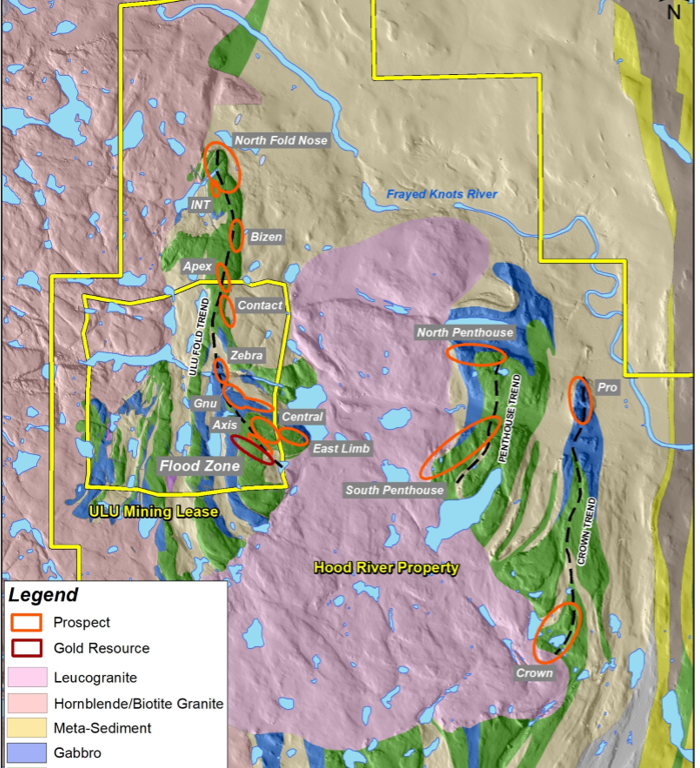

Figure 1: Map of the Ulu and Hood River Area.

Figure 2: Plan Map of 2021 Drilling.

F2021 Exploration Program

Blue Star initiated its 2021 exploration program on June 23 with a geophysics campaign, a drill campaign starting on July 16th, and surface exploration on August 1st and successfully completed all phases of the program in September.

The Exploration campaign evaluated several high priority targets in the area of the known high-grade Flood Zone Gold Deposit on the Ulu Project, and on high potential targets along the Ulu fold hinge. Numerous priority targets exist along the 5 km long Ulu Anticline which extends from the Flood Zone Deposit onto the contiguous Hood River Project up to the North Fold Nose Zone.

Targets considered high priority on the Hood River and Roma Projects had basic initial exploration campaigns to better understand host geology, confirm structures and existing anomalous zones and undertake initial geochemical surveys to determine potential to generate additional targets of interest.

Objectives of the 2021 program include better understanding the controls of higher-grade zones within the hosting structures, evaluating additional structures on and adjacent to the Ulu fold hinge, and defining additional targets for potential near-term discovery.

The balance of the assay results from the program will be reported as they are received. The slow turnaround of assays results from the lab is an issue facing the entire sector due to covid related disruptions and the high level of mineral exploration in Canada.

Technical Disclosure

Full collar tables and assay tables will be made available on the website in due course. Core samples were cut by core saw with one half of the core retained and the other half sent for analysis. Samples are being prepared by ALS Yellowknife-Geochemistry and being analyzed at ALS Global, North Vancouver. Gold analysis is by fire assay using ALS code Au-AA26 and multielement analysis by code ME-MS61. Control samples include a crush duplicate every 20 samples; certified reference material is being inserted once every ten samples. Reported assay intervals are uncapped, use a minimum 1 g/t gold assay cut off with the inclusion of up to 2 metres of material below cut-off. True widths for all but the Flood Zone are not known due to lack of drilling and may range from 90% to 95% of drilled lengths.

Qualified Person

Darren Lindsay, P. Geo. and Vice President Exploration for Blue Star, is a Qualified Person under National Instrument 43-101 (“NI 43-101”) and has reviewed and approved the technical information contained in this news release.

About Blue Star Gold Corp.

Blue Star is a gold company focused on exploration and development within Nunavut, Canada. The Company owns the Ulu Gold Property lease, an advanced gold project, and the highly prospective Hood River Property that is contiguous to the Ulu mining lease. With the recently expanded Roma Project, Blue Star now controls approximately 27,000 hectares of highly prospective and underexplored mineral properties in the High Lake Greenstone Belt, Nunavut. A significant high-grade gold resource exists at the Flood Zone deposit (Ulu lease), and numerous high-grade gold occurrences and priority targets occur throughout the Ulu, Hood River and Roma Projects.

Blue Star is listed on the TSX Venture Exchange under the symbol: BAU, on the Frankfurt Exchange under the symbol: 5WP0, and on the OTC under the symbol: BAUFF. For information on the Company and its projects, please visit our website: www.bluestargold.ca.

For further information, please contact:

Grant Ewing, P. Geo., CEO

Telephone: +1 778-379-1433

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX-Venture Exchange) accepts responsibility for the adequacy or accuracy of this Release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This press release contains “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding prospective income and revenues, anticipated levels of capital expenditures for fiscal year, expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings, and estimates of mineral resources and reserves on our properties.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets, strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses into our operations, developments and changes in laws and regulations, including increased regulation of the mining industry through legislative action and revised rules and standards applied by the regulatory bodies in Nunavut, changes in the price of fuel and other key materials and disruptions in supply chains for these materials, closures or slowdowns and changes in labour costs and labour difficulties, including stoppages affecting either our operations or our suppliers’ abilities to deliver goods and services to us, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our equipment, and inaccuracies in estimates of mineral resources and/or reserves on our mineral properties.