Vancouver, British Columbia – November 23, 2022: Blue Star Gold Corp. (TSXV: BAU) (OTCQB: BAUFF)(FSE: 5WP0) (“Blue Star” or the “Company”) provides an update on the final results from the 2022 exploration campaign. Drilling focused on both potential new resource areas and on select areas of the Flood Zone deposit to improve geological and resource modeling as part of a multi-prong exploration program across the Company’s highly prospective Ulu, Hood River, and Roma projects located in the Kitikmeot Region of Nunavut.

Exploration program results:

- Previously reported drilling highlights (see news releases dated July 20, and Aug. 17, 2022):

- 15 grams per tonne (g/t) gold (Au) over 17.65 metres, including a 6.00 m interval of 25.74 g/t gold from DD22-FLO-002 — representing the highest value (grams gold times width metres) of all intercepts drilled by the company;

- 6.52 g/t gold over 17.4 m, including 9.96 g/t Au over 6.3 m in DD22-FLO-001.

- Current highlight drill results:

- DD22-FLO-006: 4.41 g/t gold over 10.42 m, expands a shallow Flood zone hanging wall zone;

- DD22-FLO-007: 3.52 g/t gold over 4.62 m from 6.66 m depth, confirms potential for mineralization in oblique orientations to the Flood zone;

- DD22-FLO-003 and 004: confirms the presence of the Flood zone structure in the sediment core area approximately 200 m to the southeast of the deposit.

- Flood zone core resampling program highlights:

- Sampling of previously unsampled core around an historical Flood zone intercept in drill hole 04UL-02 expanded the interval to 3.18 g/t gold over 31.10 m (includes the original interval of 6.91 g/t gold over 7.45 m);

- Additional samples collected from a sampling gap between two higher-grade intervals resulted in a 6.56 m interval of 19.07 g/t gold.

Exploration Program Summary

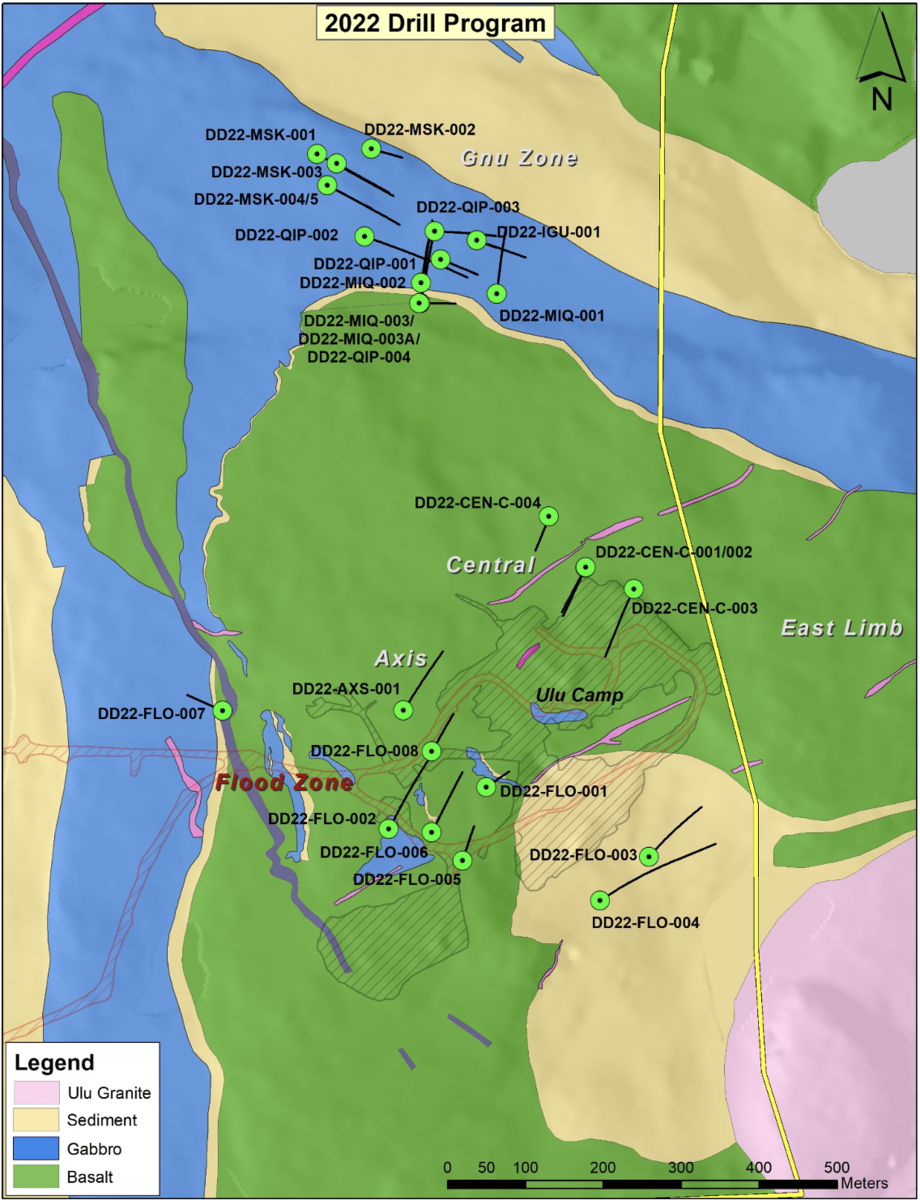

The exploration program consisted of 25 drill holes totalling 3,700 m in the Gnu (Nutaaq) zone, Central-C, Axis, sediment core and select targets in the Flood zone. The objective was to test target areas, in particular the expanding Gnu (Nutaaq) zone, and the Central-C and Axis zones, located within a few hundred metres of the Flood zone gold deposit. All drilling was completed with oriented core to assist in geological modelling. An additional sampling program of historical core from nine drill holes was undertaken to better determine mineralization boundaries due to unsampled shoulders on some mineralized zones. In addition, a 3,055-line-kilometre airborne geophysics program and a regional till sampling program on the Roma project was conducted. Detailed review and prospecting/mapping of 58 of the targets within the more than 100 compiled pipeline showings were also completed.

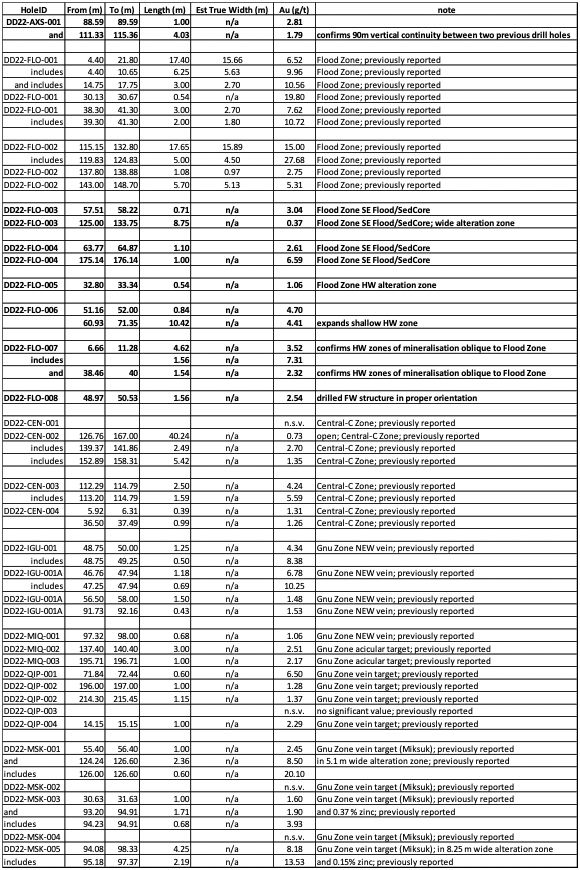

Discussion of New Drill Results Reported

DD22-AXS-001: drilled to test for mineralization subparallel to the Flood zone, while simultaneously undercutting a 2021 intercept in hole 21BSG-009 and targeting an area above a 1990 intercept in hole 90VD46. The hole was drilled through various types of basalt rock for the entire length of the hole. A zone of alternating bands of chlorite/diopside-biotite occurs in weakly strained, fine-grained basalt from 88.59 m to 90.84 m, with approximately 7 per cent pyrrhotite, 5 per cent acicular/blebby/disseminated arsenopyrite and 4 per cent pyrite. This interval returned one m of 2.81 g/t gold. Another significant mineralization zone occurs within silicified, pillow basalt from 111.33 m to 115.36 m, with approximately 8 per cent pyrrhotite, 5 per cent acicular arsenopyrite and 3 per cent pyrite. This interval returned 4.03 m of 1.79 g/t gold and confirms 90 m of vertical continuity between the 2021 and 1990 drill holes mentioned above.

DD22-FLO-003: drilled as part of a fence approximately 200 metres southeast of the main Flood zone testing for structure and the presence of basalt units in a folded structure (sediment core). The hole collared in sediments intruded by quartz-feldspar porphyry (QFP) dikes and ended in a section of conformable mafic volcanic units. A fault zone with angular fragments was intersected at 101.84 m, and a section of variably altered and mineralized mafic units was encountered between 108.95 m to 111.76 m and 125 m to 133.75 m, the latter returning a broad low-grade gold signature of 8.75 m of 0.37 g/t gold.

DD22-FLO-004: the second hole in the sediment core fence encountered variably strained sections of greywacke intruded by QFP dikes, a 0.5 m quartz vein and minor volumes of basalt before the hole ended in a two mica granitoid. Numerous clay-rich brittle faults were logged. A significant alteration zone with veining and mineralization (sphalerite more than pyrite more than galena) occurs at the sediment-granitoid contact. The best intercept in the contact zone was 6.59 g/t gold over one m.

DD22-FLO-005: drilled to test a hanging wall zone to the main Flood deposit and better define the basalt sediment contact on the west side of the Ulu fold. The hole encountered basalt, a transitional contact zone and then greywacke. A two m zone of strain and alteration was encountered in the transitional basalt immediately above the sediment contact, with disseminated pyrite more than pyrrhotite and trace arsenopyrite. Low gold grades were returned indicating continuity of the zone.

DD22-FLO-006: drilled to evaluate additional hanging wall zones closer to the main Flood zone deposit. Pillowed to massive basalt intruded by numerous QFP dikes was intersected. Moderate to strong calc-silicate alteration with increasing silicification occurs in the upper 75 m of the hole with short sections of acicular arsenopyrite present within the 61 m to 71 m interval. A one m quartz vein occurs at 106.4 m within a sheared basalt. Assays expanded the shallow hanging wall zone with results of 4.41 g/t gold over 10.42 m.

DD22-FLO-007: evaluated an inferred oblique structure the Flood zone. This hole cut only pillowed basalt; calc-silicate alteration of varying intensity was observed throughout the drill hole. Mineralization included acicular arsenopyrite observed from 7.84 m to 10.76 m. Assays indicated the potential for oblique mineralized structures to the fold zone with a result of 3.52 g/t gold over 4.62 m, including 7.31 g/t gold over 1.56 m.

DD22-FLO-008: drilled to evaluate a footwall zone that had previously been drilled from a poor direction. The hole intercepted pillow basalt and basalt flow core rock, with short intervals of argillite and chert. A fault zone with gouge and fractured core was intersected from 12.78 m to 13.55 m; a second fault occurs from 76.50 m to 76.53 m. A chert interval and the marginal basalt is mineralized with 1.5 per cent blocky arsenopyrite from 27.18 m to 31.16 m. A second mineralized interval from 48.97 m to 50.53 m is developed in strained basalt containing 7 per cent acicular/blocky/stringer arsenopyrite, 5 per cent pyrrhotite and 3 per cent pyrite stringers. This interval returned 2.54 g/t gold over 1.56 m.

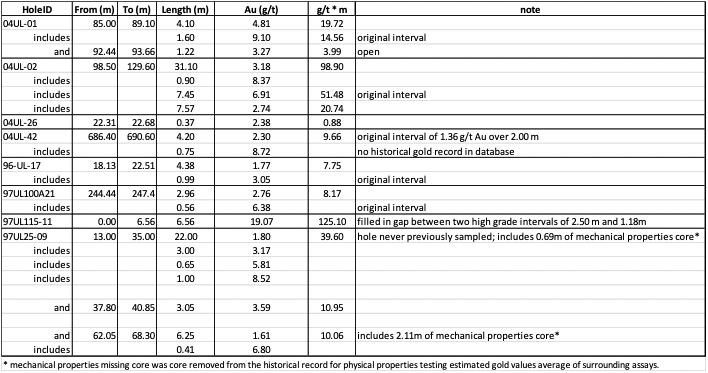

Discussion of Additional Core Sampling Results Reported

Additional core sampling was conducted on nine holes, eight of which returned values of interest. One hole had never been sampled previously as it was used to collect physical properties during a program in 1997. The holes for additional sampling were selected from a list of holes that lacked shoulder sampling that were readily identifiable in the core storage yard. All holes reviewed targeted the Flood zone at levels from 25 m to 115 m below surface.

04UL-01: additional samples were collected up and down hole from the previously modelled 9.1 g/t gold interval to better determine the boundaries of the mineralized zone. The 1.6 m modelled zone was successfully expanded to 4.1 m of 4.81 g/t gold.

04UL-02: additional samples were collected up hole and down hole form the original 6.91 g/t gold over 7.45 m interval. Sampling returned moderate to strong grades resulting in an expanded interval of 3.18 g/t gold over 31.1 m which is inclusive of the original interval.

04UL-26: no significant adjustments were made with the limited additional sampling in this hole.

04UL-42: additional sampling doubled the length of the original interval and improved the grade, providing better mineralization continuity and mineralization boundaries.

96-UL-17: additional samples up hole and down hole expanded the boundaries of the mineralized zone, providing for better continuity interpretation, however, the grade of the interval did not improve.

97UL115-11: additional sampling of this underground drill hole filled in a sampling gap between two higher-grade intervals resulting in a new single interval of 6.96 m of 19.07 g/t gold, supporting the interpretation of a single mineralized lens through this area.

97UL25-09: an underground hole used for physical properties only, never previously sampled for assay, returned three mineralized intervals including 1.8 g/t gold over 22 m (includes 8.52 g/t gold over one m), allowing for interpretation of mineralization continuity where it was not previously modelled.

Figure 1: Plan map of 2022 drill holes.

Table 1: Table of drill results

Table 2: Table of additional sampling drill results

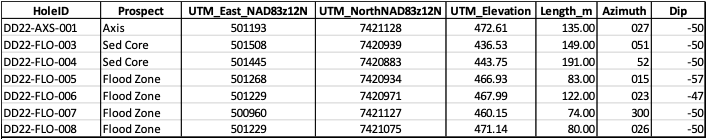

Table 3: Table of drill collar locations for holes reported in this release