Vancouver, British Columbia–(Newsfile Corp. – February 10, 2020) – Blue Star Gold Corp. (“Blue Star” or the “Company”) is pleased to report the Company has completed the acquisition of the Ulu Gold Property (the “Ulu”) from Mandalay Resources Corp. (“Mandalay”). Supplementing its high-grade gold resources, the Ulu includes a substantial inventory of capital equipment, a Weatherhaven camp with shop and a 1,200 m long airstrip. The mineral rights in the form of a Crown mining lease were transferred on January 7, 2020 to Blue Star. The Kitikmeot Inuit Association (the “KitIA”) agreed on October 1, 2019 to transfer surface access in the form of a land use licence, and on September 10, 2019 the Nunavut Water Board (“NWB”) authorized the assignment of the Ulu Water Licence 2BM-ULU1520 to Blue Star.

Through the final steps in the Ulu acquisition process, Blue Star has:

- Paid to Mandalay the final payment of $450,000 in cash upon transmittal of the Ulu mining lease to Blue Star Gold;

- Arranged for an arm’s length third party to purchase Mandalay’s 5,000,000 Blue Star shares;

- Posted remediation security required by the KitIA and the NWB in the amounts of $750,000 and $1,685,542 respectively;

- Assumed future reclamation and monitoring obligations associated with Ulu in a manner satisfactory to the KitIA and the NWB; and,

- Received from Mandalay the transfer of $1,685,542 that was released by the Crown Indigenous Relations and Northern Affairs Canada respecting Mandalay’s remediation account for the Ulu in relation to the water licence.

The Ulu Gold Property is located approximately 50 km north of the Arctic Circle in the Kitikmeot region of western Nunavut. The site of the future deep-water port at Grays Bay is 100 km to the north of the lease and the proposed route corridor for the all-weather Grays Bay road passes in close proximity to Ulu. The Property consists of the renewable 21-year Mining Lease No: 3563 with an expiry date of Nov 18, 2038 and covers an area of approximately 947 ha. The lease hosts an advanced gold project that between 1989 and 2012 saw significant exploration and development. The past work includes approximately 1.7 km of underground development and approximately 405 diamond drill holes that produced 97,820 m of core. Supplementing the exploration data, metallurgical testing by Blue Star on the Flood Zone gold mineralization has shown that gold is recoverable in amounts greater than 90% by gravity, flotation and cyanidation.

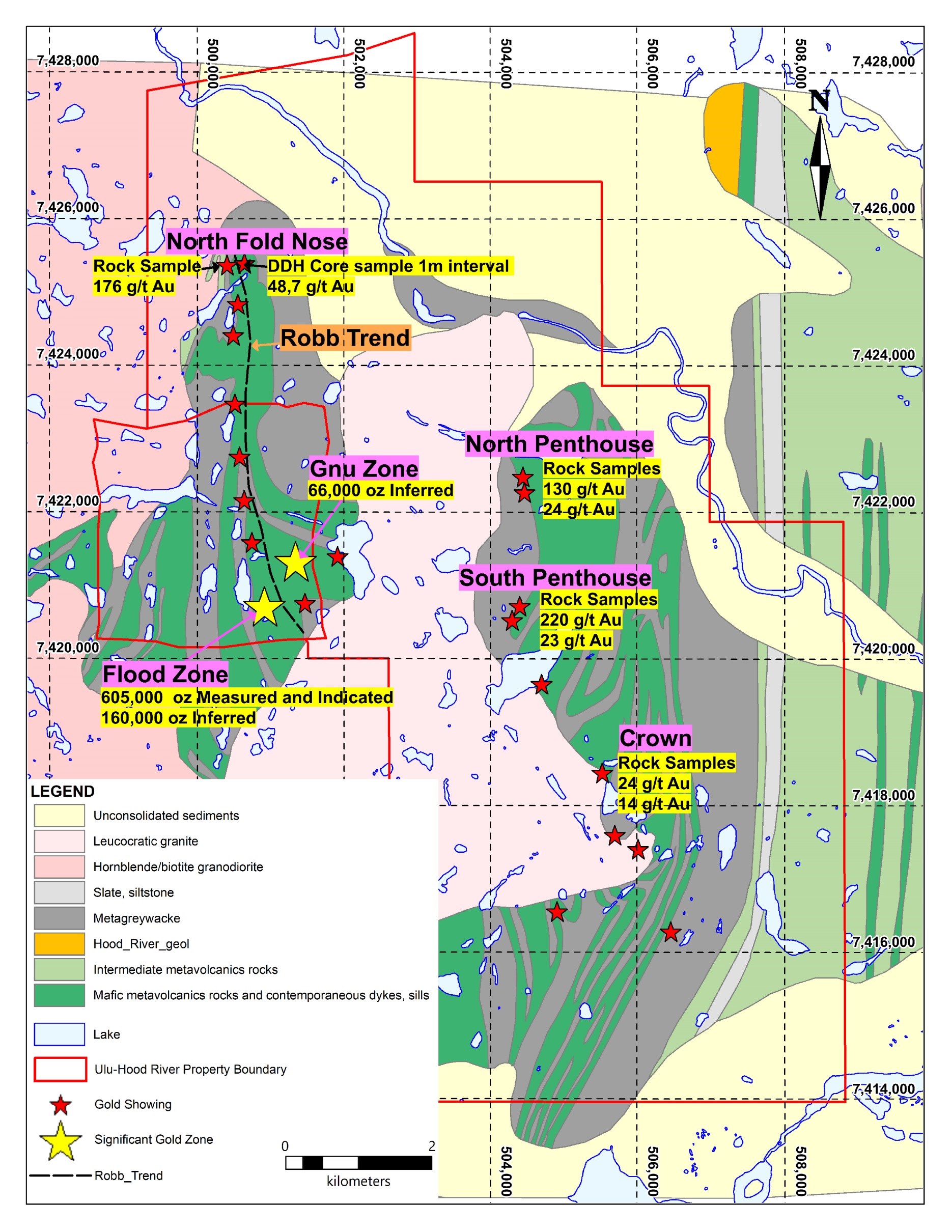

Figure 1: Blue Star’s gold occurrences and resource zones located within the Ulu Gold Property and the Hood River Concessions.

The Company filed on SEDAR its Ulu mineral resource in July 2015 (see Table One). Using a gold cut-off grade of 4 grams per tonne (“g/t”), the overall resources were reported as 2.50 million (“M”) tonnes grading 7.53 g/t Au for 605,000 gold ounces in the Measured and Indicated Categories and 1.26M tonnes at a grade of 5.57 g/t Au for 226,000 gold ounces in the Inferred Category. The Flood Zone contains the bulk of the Ulu gold resource and is open on-strike and at depth. The deepest intersection of mineable width is 14.9 g/t Au over 7.7 m in BHP’s drill hole, 90VD-75, at 610 m below surface.

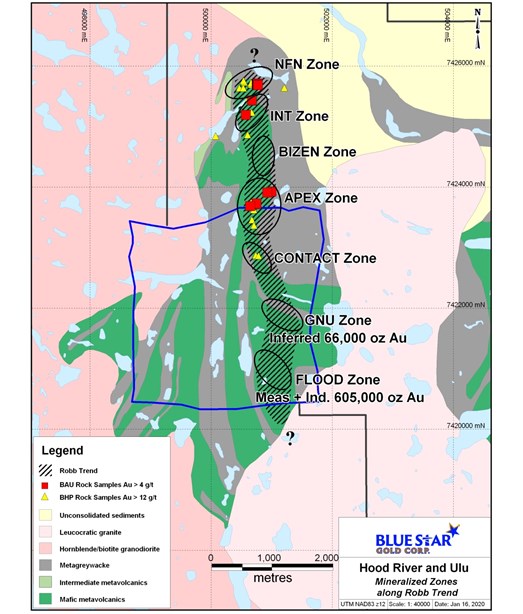

Figure 2: Blue Star’s detailed plan of the +5 km-long Robb Trend gold occurrences within the Ulu Gold Property and the north-western part of the Hood River concessions.

Stephen Wilkinson, the Company’s CEO and President commented, “With the Ulu transaction complete, Blue Star has advanced beyond junior explorer status. The entire Blue Star team is reinvigorated by this event, seeing the path forward to our targeted gold operations. Our Company now possesses assets with tangible value in the form of its measured and indicated gold resources supplemented by the infrastructure, capital equipment and Ulu’s significant database. We intend to be working as soon as practical to begin our 2020 programs of remediation at Ulu and exploration on both Ulu as well as Hood River where we believe there should be another gold trend similar to the Robb Trend.”

Table One: The Company filed its technical report, titled “Technical Report on the Ulu Gold Property, Nunavut, Canada” dated July 10, 2015 from which the table of resources was taken. Gary Giroux, P.Eng. of Giroux Consulting Inc., Bob Singh, P.Geo. of North Face Software Ltd. and Paul Cowley, P.Geo. of Buena Tierra Developments Ltd., are Qualified Persons as defined in NI 43-101 and were responsible for the preparation of the Technical Report.

| Classification | Gold | Tonnage | Gold Grade | Gold Contained | |

| Cut-off (g/t) | Tonnes | g/t | Oz | ||

| Flood Zone | |||||

| Measured | > 4.0 | 1,000,000 | 8.48 | 272,000 | |

| Indicated | > 4.0 | 1,500,000 | 6.90 | 333,000 | |

| Measured & Indicated | > 4.0 | 2,500,000 | 7.53 | 605,000 | |

| Inferred | > 4.0 | 891,000 | 5.57 | 160,000 | |

| Gnu Zone | |||||

| Inferred | > 4.0 | 370,000 | 5.57 | 66,000 | |

| Total Flood and Gnu Zones | |||||

| Measured & Indicated | > 4.0 | 2,500,000 | 7.53 | 605,000 | |

| Inferred | > 4.0 | 1,261,000 | 5.57 | 226,000 |

Notes to the Resource Estimate

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- Confidence in the estimate of Inferred Mineral Resources is insufficient to allow the meaningful application of technical and economic parameters. There is no guarantee that all or any part of a mineral resource can or will be converted into a mineral reserve.

- The mineral resources in this estimate were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

- The reliability and accuracy of downhole surveys in 188 of 313 drill holes in the resource area are in question due to their lack of proper measurements. For these holes, the QPs have imposed an average demonstrated predictability of drill hole deflection that are present in holes on the property that do have proper downhole measurements. In the opinion of the QPs, this is a more reasonable assumption than assuming straight line drill holes.

- The following parameters were used to derive the cut-off: CA$100/t mining costs, CA$25/t processing costs and CA$10/t G&A; transporting gravity and flotation concentrate to the Lupin to produce dore with a CA$25/t transport cost; CA$1500/oz gold price; process recoveries of 90%, smelter payables of Au at 96% and refining charges of Au CA$12/oz.

Qualified Person

Warren Robb P.Geo. a Qualified Person under National Instrument 43-101 (“NI 43-101”), has reviewed and approved the geological information contained in this news release.

About Blue Star Gold Corp.

Blue Star is a Vancouver-based gold and silver company focused on exploration and development within Nunavut, Canada. The Company through its subsidiary, Inukshuk Exploration Inc., owns the highly prospective 8,015 ha Hood River gold concessions located contiguous with the Ulu mining lease. Inukshuk acquired its interest in the Hood River property through a renewable, 20-year Mineral Exploration Agreement with Nunavut Tunngavik Incorporated (“NTI”) which holds subsurface title to Inuit Owned Lands (“IOL”). The Hood River property located within the CO-20 IOL parcel is administered by the NTI through the HOODRIVER-001 MEA signed between Inukshuk and NTI dated June 01, 2013. Blue Star has recently acquired the Ulu Gold Property, an advanced gold and silver project and with regulatory approvals has completed the transmittal of the mining lease and assignment of the permits and licenses. Together with the Hood River concessions, Blue Star controls nearly 10,000 ha of perspective mineral claims within which the Company has identified more than 40 gold occurrences.

Blue Star has 129.6 million shares outstanding and is listed on the TSX Venture Exchange with the symbol: BAU and on the Frankfurt Exchange with the symbol: 5WP. For information on the Company and its projects, please visit our website: www.bluestargold.ca.

For further information, please contact:

Stephen Wilkinson, President and CEO

Telephone: +1 778-379-1433

Email:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the Policies of the TSX-Venture Exchange) accepts responsibility for the adequacy or accuracy of this Release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

This press release contains “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, statements we make regarding prospective income and revenues, anticipated levels of capital expenditures for fiscal year, expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings, and estimates of mineral resources and reserves on our properties.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: economic and financial conditions, including volatility in interest and exchange rates, commodity and equity prices and the value of financial assets, strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses/our success in integrating the Ulu Gold Property into our operations, developments and changes in laws and regulations, including increased regulation of the mining industry through legislative action and revised rules and standards applied by the regulatory bodies in Nunavut, changes in the price of fuel and other key materials and disruptions in supply chains for these materials, closures or slowdowns and changes in labour costs and labour difficulties, including stoppages affecting either our operations or our suppliers’ abilities to deliver goods and services to us, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of our equipment, and inaccuracies in estimates of mineral resources and/or reserves on our mineral properties.